rsu tax rate canada

Thus would it make sense to hold ESPP stocks for two years from the start of offering period beginning of quarter. Nixon ended it in 1971 at which point the government was unconstrained by any external forces when determining economic policy.

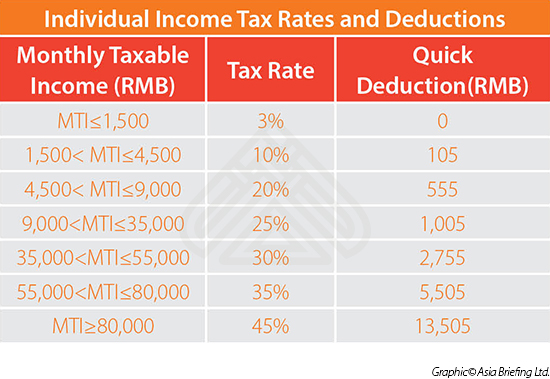

Granting Restricted Stock Units To Your Employees In China China Briefing News

How your stock grant is delivered to you and whether or not it is vested are the key.

. Conference Call The Company will host a conference call to discuss the results on today November 10 2022 at 500 pm. Click here Dial-In Number. 1 833 950 0062 Canada dial-in number Local.

Please contact the Internal Revenue Service at 800-829-1040 or visit wwwirsgov. The Rail Infrastructure Sector Understanding RSU See Annex V of the Arrangement was implemented in January 2014. 1 226 828 7575 United States.

This annex provides more flexible terms and conditions for the provision of officially supported export credits relating to new railway infrastructure projects to meet the variable needs of public authorities and exporters and to promote the use of rail as a. ESPP Tax if there is no lookback provision. May 7 2020 5 Comments.

1 844 200 6205 United States Local. The holding will call into question many other regulations that protect consumers with respect to credit cards bank accounts mortgage loans debt collection credit reports and identity theft tweeted Chris Peterson a former enforcement attorney at the CFPB who is now a law. With so many options finding the best mortgage rate.

This is effected under Palestinian ownership and in accordance with the best European and international standards. I was shocked to see that my company sold 70 of my shares to cover for taxes. Canada French United States English United States Spanish.

MiTek Incs CRA Business ID is 823629316 RT0001. 1 646 904 5544 All other locations. The business mileage rate for 2022 is 585 cents per mile.

Natixis Interépargne Tél. Learn about the latest tax news and year-round tips to maximize your refund. The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of June 30 2021 the last business day of the registrants most recently completed second fiscal quarter was 857 billion based upon the closing price reported for such date on the Nasdaq Global Select Market.

Fidelity Investments offers Financial Planning and Advice Retirement Plans Wealth Management Services Trading and Brokerage services and a wide range of investment products including Mutual Funds ETFs Fixed income Bonds and CDs and much more. Sales and Use Tax Notice for Canadian Customers of Intangible Products. Breaking news from the premier Jamaican newspaper the Jamaica Observer.

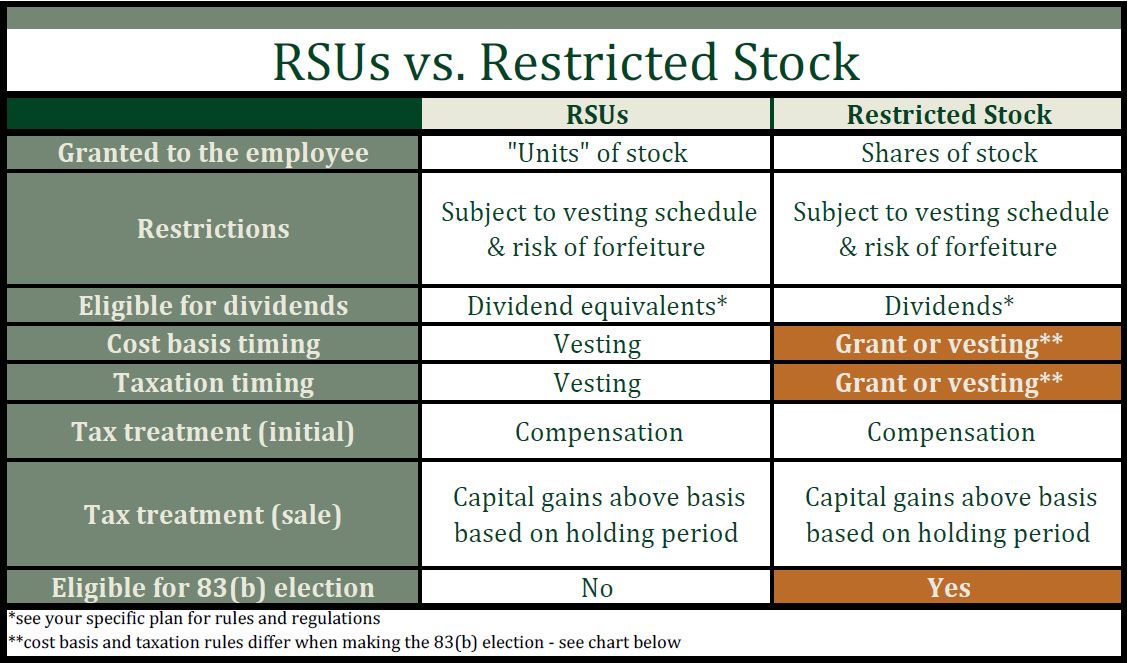

Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash. Ultimately the Missions. Entry into a Material Definitive Agreement.

Have a question about per diem and your taxes. Bretton Woods was a defacto global monetary system with other currencies tied to the dollar and the dollar convertible to gold at a fixed rate. Updated Alternative Minimum Tax AMT rates in the Tax Planner.

On January 28 2022 the registrant had. GSA cannot answer tax-related questions or provide tax advice. Total net revenues from sale of adult use cannabis in Canada of 198 million for the three months ended September 30 2022 a 19 decrease from the same period last year and a 28 increase year.

Your employer should report this amount on Form W-2 or other applicable tax documents and it will be subject to income tax. An issue where some fields of a manually created investing account were prepopulated. Follow Jamaican news online for free and stay informed on whats happening in the Caribbean.

Canada dial-in number Toll-Free. Comprised of representatives from. Even though E-Trade charges a.

A communication made in reliance on Rule 134 must contain the statement required by Rule 134b1 and information required by Rule 134b2 unless the conditions of Rule 134c are met. Harvard student discount apple Sep 14 2021 70 tax withholding on RSU - Transferred from US to Canada Lyft yYii18 Sep 14 2021 21 Comments Hi All I was recently transferred from US to Canada on 1 year work assignment and recently got my 1st stock vest in Canada. The best five-year fixed mortgage rates in Canada 2022.

ETRADE at 1-800-838-0908 US ou 1-650-599-0125 outside US Epargne. The after-tax internal rate of return for the Project is estimated at 824 with an estimated after-tax net present value of US19 B at an 8 discount rate. With the Canada Revenue Agency and is required to charge all applicable GSTHST on intangible products sold in Canada.

Microsoft ESPP has no lookback provision ie the price is discounted only on the market price at the last day of offering period quarter. You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use the rate under the cents-per-mile rule to value the personal use of a vehicle you provide to an employee. Following a bumpy launch week that saw frequent server trouble and bloated player queues Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 daysSinc.

In addition if the communication solicits from the recipient an offer to buy the security or requests the recipient to indicate whether he or she. 02 31 07 74 00. That means the impact could spread far beyond the agencys payday lending rule.

Get unlimited advice from live tax experts as you do your taxes or let an expert do it all for you start to finish. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. See Cents-Per-Mile Rule in section 3.

Ability to exclude hidden or closed accounts in Find and Replace operations. For example if you have 100 shares that vest when the stock price is 30 per share and you did not pay for the shares youll recognize ordinary income of 3000 in the year the shares vest. Unisys Stock Options Restricted Stock Unit RSUs plans Employee Stock Purchase Plan Contacts.

1 929 526 1599. Stock grants often carry restrictions as well. Support for the 396 federal tax rate in the Capital Gains Estimator.

As the name implies RSUs have rules as to when they can be sold. In connection with the Distribution the company entered into several agreements with RXO that govern the relationship of the parties following the Distribution including a Separation and Distribution Agreement a Transition Services Agreement a Tax Matters Agreement and an Employee Matters. Canadas best credit cards for people with bad credit 2022.

Data Link to convey RSU load data into RemRate 6900. The debt to GDP ratio in 1971 was about 35 and declining.

How To Avoid Taxes On Rsus Equity Ftw

Amazon Stock Rsu Global Agreement Pdf Pdf Vesting Withholding Tax

What You Need To Know About Restricted Stock Units Rsus Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Ltip Beyond The Mainstream Alternatives

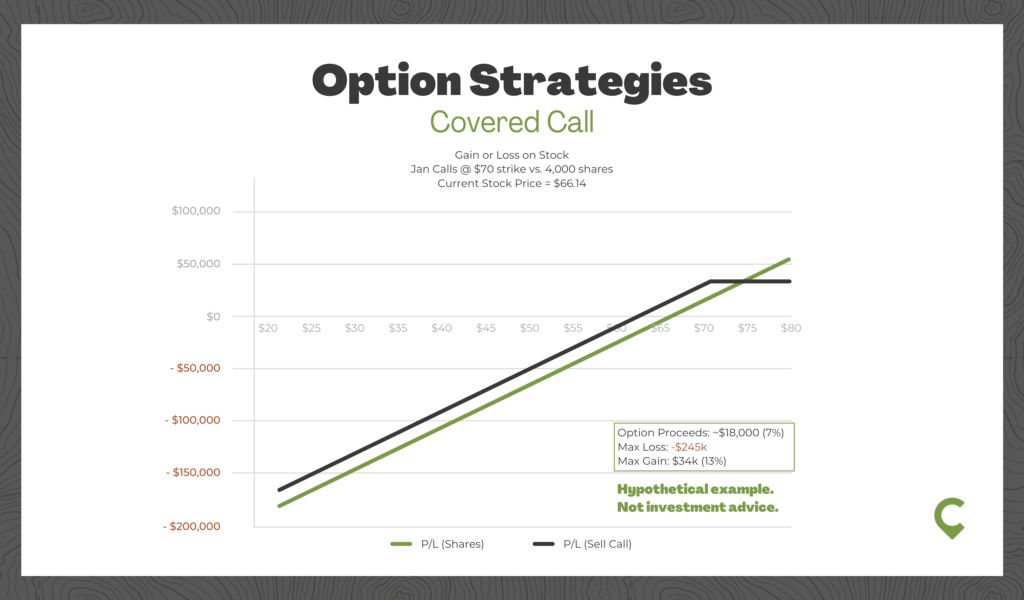

How Do I Diversify My Rsus Executive Benefit Solutions

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law Firm

Rsu Taxes Explained 4 Tax Strategies For 2022

California Payroll Conference Ppt Video Online Download

Rsu Taxes Explained 4 Tax Strategies For 2022

2021 Capital Gains Tax Rates In Europe Tax Foundation

:max_bytes(150000):strip_icc()/Restricted-stock-unit-c46e678be3ea4ed19368bec0f1adb990.jpg)

Restricted Stock Unit Rsu How It Works And Pros And Cons

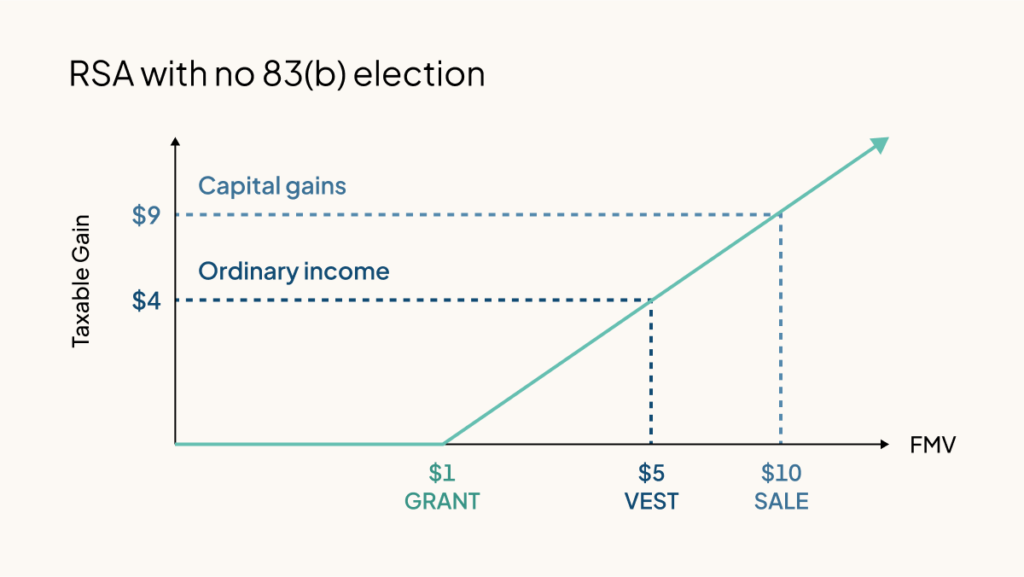

Rsa Vs Rsu What S The Difference Carta

Taxation Of Stock Options For Employees In Canada Madan Ca

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen